Republished with permission from Thom Hartmann

Most Americans have a radically incomplete understanding of how taxes work. As a result, changes to the tax code made by Republicans in the years since the Reagan Revolution have done real damage both to the American economy, working class people, and to the vibrancy and viability of our towns and communities.

Just like the debates around raising personal income tax rates are demagogued by rich people and their shills, there’s a world of misinformation around the issue of raising corporate income taxes.

Most of these myths promoted by the morbidly rich exploit the fact that only a tiny fraction of Americans have ever run a business or taken a business course in college, and so most Americans don’t have a clue how corporate income taxes work.

They think that if you tax corporations, those corporations will both pay and then pass that tax along as higher prices. That’s only rarely true because there are so many good things that corporations can do that will reduce or eliminate their taxes altogether.

They also think that taxing corporate profits somehow cripples or weakens them. In fact, it does the opposite: it strengthens and expands companies because of the positive behaviors that the threat of taxation provokes.

For example, back in the early 1970s (before Reagan), the late Terry O’Connor and I owned a small herbal tea, potpourri, and smoking mixture company that was doing very well. We had about a dozen employees, were buying herbs by the ton mostly from Eastern Europe, and selling our packaged herbal products nationwide. We were making good money for a couple of guys in their early 20s.

At the time, the top income tax rate for a corporation was 48 percent (down from 52.8 percent in 1969) on profits over $25,000, and as we approached year’s end we were showing what would be a profit well in excess of that.

My dad, who did the bookkeeping for the small tool-and-die shop where he’d worked since 1957, was our business mentor (and taught Terry, Louise, and me double-entry bookkeeping) so we sat down with him and asked him what to do.

Our first idea was to simply distribute the profit to ourselves as a paycheck.

My dad put the kibosh on that idea, because we were both already making enough that the top part of our income was being taxed at 60 percent, which meant almost two-thirds of every additional dollar we took would simply go to the federal government. (We were paying ourselves about three times what our workers were making, and they were paid at Lansing union scale along with full health insurance.)

“Leave that money in the company,” Dad advised us. “You’ll get your payday when you sell it and only have to pay long-term capital gains taxes.”

At first we thought that was bad advice.

“But if we keep the money in the company, it’ll have to pay 48 percent taxes on the profits!” we objected. “Why just give it to Uncle Sam?!?”

I remember my dad smiling at that.

“That’s why there are tax deductions,” he told us, as I recall. “They’re designed to incentivize particular behaviors that are good for the country and good for your business as well.”

The particular tax deductions he suggested we use were to give our employees a raise, invest in advertising and marketing to increase our sales, and to develop a new product line. Advertising, salaries and benefits, R&D, and new product development were all fully tax-deductible (and still are).

We took his advice and grew the company from a dozen employees to around 18, made a pile of money selling the new ginseng product we developed with those profits to Larry Flynt, and eventually cashed out when we sold the company to several of our employees in 1978.

This example highlights how there are really two reasons for both personal and corporate taxes, and they’re both based on similar rationales.

The first reason—the one everybody understands—is to raise money to pay for government services that benefit us all. Taxes, as FDR often said, are “the price of admission to a civil society.”

The second, though, is really the most important: taxes are used to incentivize behaviors that are good for the nation and discourage behaviors that are destructive to the nation.

This is where Reaganomics has not only screwed average American working people but screwed American business—particularly small and medium-sized businesses—as well.

While America is still a wellspring of innovation, we could be doing so very much better. For example, just the mostly tech companies listed in the S&P 500 bought back $882 billion of their own shares in 2021 and over $1 trillion in 2022. And that’s nearly two trillion dollars spilling out of just one or two market sectors!

Two trillion dollars is four times the cost to eliminate all poverty in the United States.

So, you’d think that if America’s biggest companies were spending roughly a trillion dollars every year they were doing something important with it.

You’d think that maybe they were doing it because the government had provided them with some incentive, either direct payments or tax advantages, to do it.

Sadly, you’d be wrong: that’s very much not the case.

Not one penny of that nearly $2 trillion in 2021 and 2022 went to developing new products, promoting existing products, paying employees better, building new facilities, or supporting the communities in which they operate.

Instead, virtually all of that money went straight into the pockets of shareholders, senior executives, and CEOs who are compensated with stock and stock options.

Before Reagan, this was a felony crime called “stock manipulation”; CEOs who executed share buybacks just to artificially inflate stock prices could go to prison.

FDR criminalized share buybacks in the early 1930s because they’re simply a form of stock price manipulation and were one of the main reasons for the stock market crash of 1929 that kicked off the Republican Great Depression.

Which super-illustrates the point that there’s nothing magical, normal, or “natural” about national economies. They’re not the result of immutable laws, any more than the NFL’s rules for football are.

The rules of marketplaces are created by governments, and governments decide who will benefit from those rules. And in the 1980s, Reaganomics shifted the priority of the rules of business from helping workers, communities, and the overall American economy to purely supporting the morbidly rich CEOs and trustfund babies who funded Reagan’s election.

Today’s post-Reagan Revolution personal and corporate tax situation is very intentional, including its outcomes of massive inequality, mind-boggling riches in a few hands, and widespread poverty across the land.

It follows a plan that was first laid out by President Reagan, later executed by Speaker Newt Gingrich, and then continued by the Republicans who followed them in both the White House and as Speakers of the House of Representatives. And, of course, Mitch McConnell in the Senate.

None of it is accidental, and none of it follows some sort of ancient natural law—other than that the demands of greed are almost always in conflict with the needs of the mass of the people, and have been throughout history.

In an effort to get corporate share buybacks under control, the Inflation Reduction Act finally put a tax of a 1 percent on them. We really need to reverse Reagan’s actions and re-criminalize buybacks—or tax them at 50 percent or more—so if companies want to jack up dividends and share prices they will have to do it the old-fashioned way: by having actual successes in the marketplace, like before 1983.

(There’s an in-depth explainer about how share buybacks work and the damage they do to both our economy and working people that I published here a year ago last December.)

Which brings us to the reason why we should go back to the 52 percent top corporate income tax bracket that was in place until the Reagan Revolution.

There was hardly a company in America that paid that 50 percent tax, but that doesn’t mean it was ineffective. Just like my dad advised Terry and me, companies across America avoided paying income taxes by using their surplus cash to pay their employees better, offer expanded benefits, build new products and facilities, improve their marketing, and help out the communities in which they do business.

These things that derive from a high corporate tax rate all benefit the company, the workers, and the communities where they operate. They make America stronger.

Expanding innovation and product lines makes the companies and the economy more vibrant. They build and strengthen the middle class. They even help the entire nation via the federal and state governments, because companies must show some profits (as they become more successful) to distribute dividends to shareholders and those profits are taxed, producing government revenues.

All those activities mentioned above are tax-deductible. Which shows how important it is to have a high corporate income tax rate because, with the current absurdly low tax rates, companies have little incentive to do anything other than buy back their shares and make their already morbidly rich CEOs and major investors even richer.

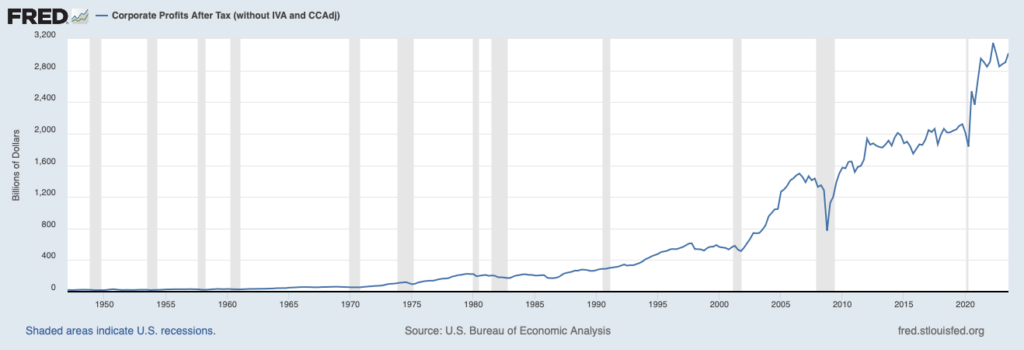

Former Labor Secretary Robert Reich recently published in his excellent Substack newsletter a graphic from the St. Louis Fed showing how corporate profits have exploded over the past few decades.

While Reagan set the stage, today’s predatory levels of corporate profits exploded because of the hundreds of holes George W. Bush and congressional Republicans drilled in our corporate tax code with their two massive corporate tax cuts: the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) in 2001 and the Jobs and Growth Tax Relief Reconciliation Act (JGTRRA) in 2003.

Trump doubled down in 2017 and 2020 with two new mammoth corporate tax cuts of his own, and you can see the result in the graph:

When you look at the graph, think of the increase in corporate profits—money after taxes that’s left to distribute to stockholders and executives—as a theft from the corporations themselves.

Those profits mean that the companies generating them have prioritized shoveling money to their owners instead of growing their businesses or improving their products. It’s a sign of how unhealthy American business has become, and explains why they fight so hard to prevent unionization (which, during Eisenhower, grew because employee pay and benefits are tax deductible).

Reich noted that this explosion in corporate profits was largely the result of their monopoly power, echoing my book The Hidden History of Monopolies: How Big Business Destroyed the American Dream (foreword by Ralph Nader), which we’re serializing right now here on the Hartmann Report.

But had it not been for changes in tax policies that let those profits accumulate and be distributed to the morbidly rich who own most of America’s stock, that money instead would have gone into developing new products, paying workers better, and building new facilities.

As the Institute on Taxation and Economic Policy noted in a recent report, the damage from the Reagan, Bush, and Trump corporate tax cuts is extraordinary:

“At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States. This continues a decades-long trend of corporate tax avoidance by the biggest U.S. corporations…

“The tax-avoiding companies represent various industries and collectively enjoyed almost $40.5 billion in U.S. pretax income in 2020, according to their annual financial reports. The statutory federal tax rate for corporate profits is 21 percent. The 55 corporations would have paid a collective total of $8.5 billion for the year had they paid that rate on their 2020 income. Instead, they received $3.5 billion in tax rebates.”

The examples they gave are stark:

“Food conglomerate Archer Daniels Midland enjoyed $438 million of U.S. pretax income last year and received a federal tax rebate of $164 million.

“The delivery giant FedEx zeroed out its federal income tax on $1.2 billion of U.S. pretax income in 2020 and received a rebate of $230 million.

“The shoe manufacturer Nike didn’t pay a dime of federal income tax on almost $2.9 billion of U.S. pretax income last year, instead enjoying a $109 million tax rebate.

“The cable TV provider Dish Network paid no federal income taxes on $2.5 billion of U.S. income in 2020.

“The software company Salesforce avoided all federal income taxes on $2.6 billion of U.S. income.”

And that’s just the tip of the iceberg.

It’s time to punch a hole in the neoliberal lie that high tax rates hurt countries and companies. The only group that “suffers” from high taxes are companies that refuse to innovate, and morbidly rich CEOs who want to keep bleeding their companies dry.

Taxes, after all, are an incentive for corporations to do the right thing, but in 2018 the Trump administration dropped the top corporate tax rate from 38 percent all the way down to 21 percent. That Republican tax legislation destroyed much of that incentive for good behavior.

If we want the vigorous, dynamic economy we had during the period from 1932 to the 1990s, we must restore the top 52 percent corporate tax bracket that Republican President Dwight Eisenhower championed and oversaw throughout his and JFK’s presidencies (and that stayed well above 40 percent until Reagan went after them in 1988).

It’s time to again tax the rich, be they individuals or giant corporations, to restore the American middle class and return our nation to the vitality that, before the Reagan Revolution, was normal.

Thom Hartmann

Thom Hartmann, one of America’s leading public intellectuals and the country’s #1 progressive talk show host, writes fresh content six days a week. The Monday-Friday “Daily Take” articles are free to all, while paid subscribers receive a Saturday summary of the week’s news and, on Sunday, a chapter excerpt from one of his books.